Learn About the New CareCredit Integration Within Cornerstone

What is CareCredit?

CareCredit is a health and pet care credit card with flexible financing options that gives clients a way to pay overtime.

The CareCredit credit card can be used for routine veterinary appointments, grooming services, emergency pet care, or a variety of surgeries and treatments at veterinarian locations that accept the card. It helps to give pet owners the peace of mind needed to care for pets big and small.

What is the CareCredit Integration within Cornerstone?

With the CareCredit integration, you can now add CareCredit as a payment method within your Cornerstone application. You no longer will need to open a new web browser to log in to your CareCredit account, instead, you can stay logged in, look up client accounts, and process transactions directly in Cornerstone making it easy to offer CareCredit as a financial option to your clients.

How does the CareCredit Integration work?

What are the benefits of the CareCredit Integration?

The integration allows practices to process purchases or refunds directly from Cornerstone. Purchases can be processed in person or sent to a pet owner by email or text. This means:

No more switching to a browser and navigating to the CareCredit webpage.

No more logging in to CareCredit with credentials you or your staff may not remember.

No more typing in pet owner information to search for their CareCredit account.

No more typing in amount of payment, or remembering to mark it paid in Cornerstone.

No more end of day balancing of CareCredit transactions.

How do I get the Cornerstone CareCredit Integration?

First, ensure you have an existing CareCredit account. To sign up for CareCredit please visit: https://www.carecredit.com/providers/contact-team/

Cornerstone 9.6 users:

1. To complete your simple integration setup and to start using the CareCredit integration in Cornerstone, please see: “How do I activate the CareCredit integration in Cornerstone?”

Cornerstone 9.5 users:

To confirm you are on Cornerstone 9.5 go to: Help > About IDEXX Cornerstone.

1. Click HERE to request the CareCredit Integration be sent to your server.

Important - When Scheduling a Time:

- Cornerstone must be closed on your server and all workstations.

- The server must be left on during the scheduled time frame.

- Plan for approximately 1-2 hours of down time just to be safe (recommended overnight).

- 24-hour practices that feel they are unable to plan for 1-2 hours of downtime, please contact Cornerstone Support for assistance.

2. Once the CareCredit Integration is on the server, a message will appear in Cornerstone asking to close and reopen. This will happen once per workstation, typically the morning after the server updates.

3. Once complete, the CareCredit Integration is ready to be activated for use. Please see: “How do I activate the CareCredit integration in Cornerstone?”

Cornerstone users PRIOR to 9.5:

Please look at upgrade options here: https://www.idexx.com/en/veterinary/software-services/cornerstone-software/current-customers/

Integration FAQs

How do I activate the CareCredit integration in Cornerstone?

Watch this short video detailing how to activate the CareCredit Integration as a new payment type in your payment settings.

What information do I need to setup the CareCredit integration?

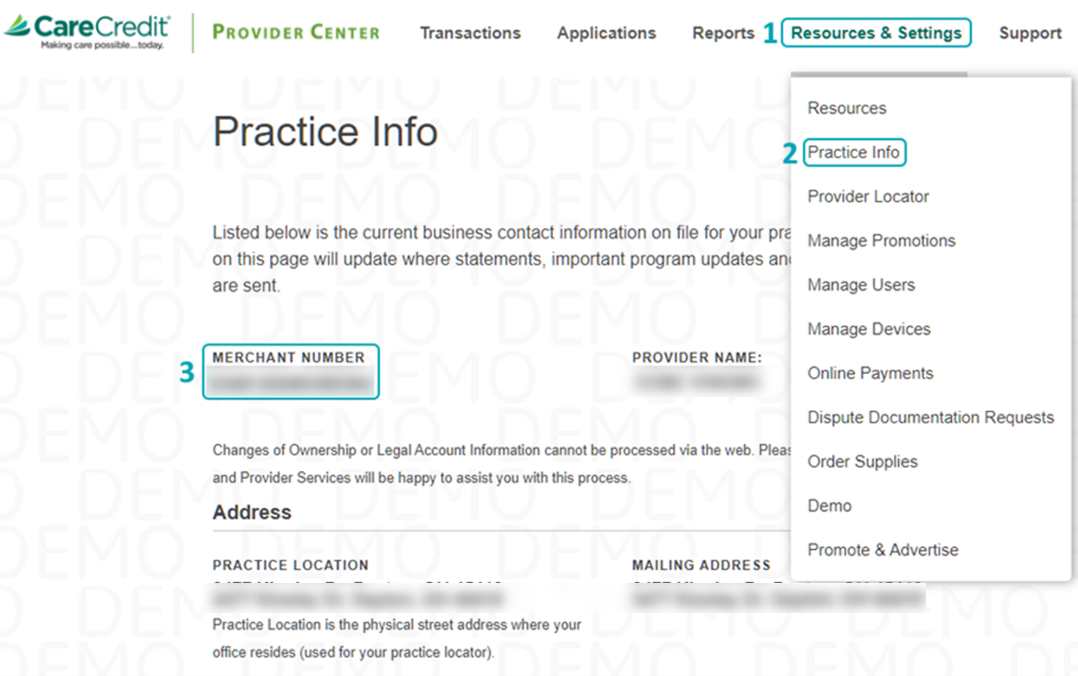

First, you need Cornerstone version 9.5 with the proper updates in place. Next, you will need your CareCredit MID (Merchant Number) which can be found in the CareCredit Provider Center:

Do I need to contact IT to set up this integration?

First and foremost, we've designed this integration with simplicity in mind. The process is straightforward and user-friendly, meaning you won't need to burden your IT team with this task. Here's how easy it is:

-

Self-Sufficient Process: The integration process is designed to be managed internally with minimal effort. It does not require technical expertise or background, and no one must be present during the push to your server.

-

Security and Compliance: Your data's security is paramount. Rest assured, this integration meets all industry-standard security protocols and compliance requirements.

-

Real Benefits, Real Practices: Many practices like yours have successfully integrated Cornerstone and CareCredit without IT intervention and are now enjoying streamlined operations and improved efficiency.

What should I do with my existing CareCredit payment type after I enable the Integrated CareCredit payment type?

It is recommended that you change the name of the existing payment type to Offline CareCredit. This will allow any transaction that was processed outside of the integration to be manually entered.

How else can I use the CareCredit Integration to process payments?

You can learn to take a CareCredit payment on a client account by watching this video. You can also learn how to send a CareCredit paylink via SMS by watching this video.

I sent a CareCredit payment by text or email. How can I check to see if it was complete?

Cornerstone will automatically check to see if transactions are processed for up to 10 days. You can force a check at any time by opening the Client Account screen and clicking CC Status OR right click the Account Information section of the Patient Clipboard and click CareCredit Status.

What is my Merchant ID or Merchant Number?

Your Merchant ID, MID or Merchant Number is your unique identifier for CareCredit and can be found in your CareCredit Provider Center. Please reference “What information do I need to set up the CareCredit integration” for more detail.

Where do I manage admin tasks like promotional options?

Practices will continue to manage these in their CareCredit Provider Center Portal as they have in the past.

How much does the integration cost?

There is no cost for practices to utilize this integration. Practices enrolled in CareCredit can enable the integration for free.

Why should I use the CareCredit integration?

If you want to easily offer CareCredit as a potential financial solution for your patient’s care without spending the extra time opening browsers to access the CareCredit website to process a transaction, then you should turn on the integration and process transactions directly from Cornerstone.

Can I refund CareCredit transactions within Cornerstone?

Yes, practices can view and select from a list of previous transactions to easily process refunds directly in Cornerstone.

Can practices send CareCredit applications from the CareCredit integration?

Yes, practices can easily send clients CareCredit applications directly from Cornerstone by clicking on the CareCredit icon in their Cornerstone toolbar or by going to “Activities” and then clicking “CareCredit.”

CareCredit FAQS

What is CareCredit?

CareCredit is a health and pet care credit card with flexible financing options that gives clients a way to pay overtime. The CareCredit credit card can be used for routine veterinary appointments, grooming services, emergency pet care, or a variety of surgeries and treatments at veterinarian locations that accept the card. It helps to give pet owners the peace of mind needed to care for pets big and small.

How does CareCredit work?

-

Enroll to accept CareCredit

-

Promote to your clients

-

Your clients apply and pay

-

You get paid in 2 business days

Why would practices want a financing option like CareCredit?

CareCredit allows practices to offer promotional financing, allowing pet owners to give their pets care and pay overtime, practices receive payment in two business days without the risk of future non-payment (subject to the representations and warranties in the Agreement with Synchrony).

Cornerstone has partnered with CareCredit to deliver a streamlined experience that will help reduce time spent and allow practices to offer financing options with less effort.

What type of fees are incurred when offering CareCredit?

After enrollment, you will only pay processing fees, which are based on a few factors including which special financing options you offer and are chosen by your clients. There is no recurring annual fee for providers.

Do clients find value in CareCredit?

95% of Cardholders rate CareCredit a “good” to “excellent” value. (CareCredit Cardholder Engagement Study, 2023)

What happens if a CareCredit Cardholder does not pay?

CareCredit payments to Providers are non-recourse, even if a Cardholder delays payment or defaults with Synchrony (subject to the representations and warranties in the Agreement with Synchrony).

How long does it take to receive payment from CareCredit?

Practices receive payment within 2 business days.

How can a patient add authorized users to their CareCredit credit card?

Clients can add authorized users to the account, which gives them the ability to use the account for medical expenses, by calling CareCredit at 800-859-9975 or by logging in to their account on carecredit.com and accessing the Services tab.

Can a patient pay for someone else using their CareCredit credit card?

Clients can use their CareCredit credit card to pay for their family and pets, however, the one presenting payment must be the primary cardholder or an authorized user.

How can practices sign up for CareCredit?

Practices can apply to enroll with CareCredit by visiting: https://www.carecredit.com/providers/contact-team/

Can I use the integration if I do not have CareCredit?

No, you cannot use the integration if you do not have CareCredit. If you are interested in learning more about CareCredit, please visit https://www.carecredit.com/providers/animal-healthcare/

How can a client apply?

Clients can easily apply on their own and get immediate credit decision by:

-

Visiting carecredit.com

-

Calling: 855-844-0028 (Must be 21 or older to apply by phone).

Can clients use their card right away?

If approved, clients will receive their CareCredit card account number for immediate use. Their physical CareCredit credit card will arrive in the mail in 7-10 business days.

Can I apply on my client’s behalf?

At your client's request, you can submit an application for them in the Provider Center.

This functionality is not available for providers in California who are prohibited under state law from submitting applications on behalf of clients for certain healthcare loans or lines of credit, including the CareCredit credit card.

If a client submits a prequalification request, what are the possible outcomes?

1. Clients are prequalified and can accept the offer and apply for the CareCredit credit card.

2. Clients are not prequalified and there is no impact on their credit score.

How can a client request a necessary credit limit increase?

Cardholders can request a credit limit increase by logging in to their CareCredit account on carecredit.com and accessing the Services tab or calling Customer Service at 800-859-9975.

Does CareCredit integrate with my payment terminals?

No. CareCredit is integrated with Cornerstone but does not require or use a payment terminal. The account can either be typed in or searched using prepopulated data.

Support

Who should practices contact for questions regarding Cornerstone?

For general Cornerstone questions please see: https://www.idexx.com/en/veterinary/support/documents-resources/cornerstone-software-resources/

Who should a practice contact for questions regarding their CareCredit account?

Contact your CareCredit Practice Development Manager or call 1-800-859-9975.

Who should practices contact with billing or technical support issues regarding CareCredit?

Practices should contact CareCredit:

-

Phone: 1-800-859-9975

-

8:00 am – 12 am EST (Monday to Friday), 10:00 am- 6:30 pm EST (Saturday)

What additional support resources are available?

Download and print the “Activating CareCredit” and “Taking a CareCredit Payment” guides.