5 Veterinary Practice Finance Mistakes to Avoid

Delivering high-quality veterinary care is the primary goal of veterinary medicine, and the business side can sometimes take a backseat. However, failing to actively monitor your veterinary practice finances can allow inefficiencies, missed opportunities, and significant financial mistakes to creep in.

All veterinary clinics, regardless of their practice area or hospital size, can benefit from tighter control and a clearer understanding of their financial picture. Here are five common financial mistakes that veterinary practices make, and what you can do to avoid them.

1. Burying your head in the sand

Your balance sheet and P&L report aren’t reserved exclusively for your accountant’s eyes. Financial statements like these are critical to your understanding of the hospital’s financial health, yet many veterinary professionals and leaders fail to check them as often as they should.

Without regular financial reviews, you could miss subtle changes that mean significant losses over time. Gradual supply or payroll costs that outpace revenue growth impact long-term profitability, but you can’t fix a problem you don’t know about.

Manage your veterinary practice finances more effectively by adding monthly or quarterly reviews to your calendar. Meet with your accountant, bookkeeper, or financial advisor for help connecting the numbers to real-world decisions about the clinic’s future.

2. Confusing revenue with financial strength

A growing practice isn’t necessarily a profitable one. Many veterinary hospitals see increased revenue year over year but struggle with rising expenses and thinning margins. Revenue optimization matters more than gross revenue. Look at where money goes and whether each area of your practice is contributing to financial stability or dragging it down. Are services priced appropriately? Is inventory managed effectively? Operational efficiency determines whether revenue can support your long-term goals and strengthen your veterinary practice finances.

3. Failing to track cash flow

You can be profitable on paper and still find yourself scrambling to pay bills. While profitability looks at the big picture over time, cash flow reflects what’s happening in the moment and how much money is in your account when expenses are due. Cash flow issues can arise when large bills, such as rent or vendor payments, coincide with slower weeks or delayed client payments.

If you’ve recently invested in new equipment or expanded services, that can also strain your available cash. If your clinic offers payment plans, some of your revenue might not hit your bank account right away. Monitor cash flow weekly to support stable veterinary practice finances and decide when to hold off on big purchases or when to move forward with planned investments.

4. Focusing on the short term

Most business owners are busy. Between patient care, team leadership, and the demands of running a veterinary clinic, financial planning for the future may get overlooked. However, avoiding decisions about real estate, retirement, hospital sale, or equipment investments can cost you later.

Having a solid grasp of your current finances also makes it easier to understand the value of your practice. Periodic valuations help you plan for your personal future and what will happen to the practice when leadership retires.

Long-term thinking can begin with a conversation about goals: What do you envision your veterinary practice's finances will look like in five years? What’s your plan for transition or sale? The answers to these future questions should shape your financial decisions now.

5. Underestimating retention and communication

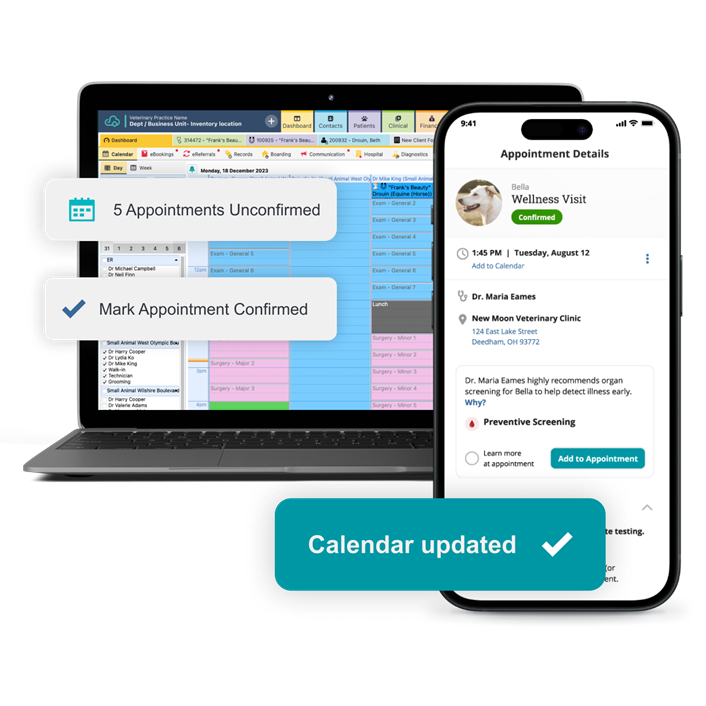

Missed annual visits, overdue vaccinations, and delayed follow-up care can chip away at veterinary practice revenue. A slow decline in client engagement can go unnoticed until it shows up in your numbers, making you realize that retention problems have financial consequences.

Small, consistent efforts, including reminders, follow-up texts, and social media posts, can help keep pet owners connected to your practice. When clients feel informed and supported, they’re more likely to return regularly and follow through on recommended healthcare. For stronger veterinary practice finances, use your cloud-based practice management software to automate communications and make them part of your routine.

Financial clarity for veterinary practices

You don’t have to be a finance expert to run a successful practice, but getting comfortable with the basics of veterinary practice finances gives you more control over your business. When you understand where money goes and why, you can make informed decisions that support your goals without sacrificing patient care or team well-being.